unemployment tax break refund status

See How Long It Could Take Your 2021 Tax Refund. Check Your 2021 Refund Status.

Unemployment Tax Refund Update What Is Irs Treas 310 11alive Com

Numbers in Mailing Address Up to 6 numbers.

. Ad Premium federal filing is 100 free with no upgrades for unemployment tax filing. The first refunds are expected to be made in May and will continue throughout the summer. Social Security Number 9 numbers no dashes.

22 2022 Published 742 am. Since the IRS began issuing refunds for this it has adjusted the taxes of 117. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. IRS sends out another 430000 refunds for 2020 unemployment benefit overpayments. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset debt.

Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. IR-2021-151 July 13 2021 The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes. Oscar Gonzalez 1122021.

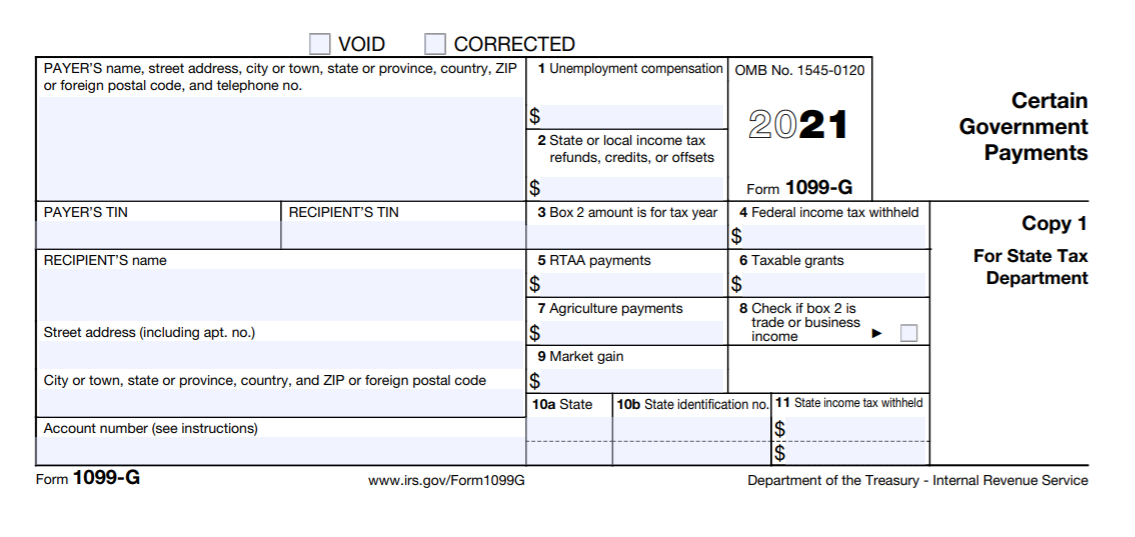

When depends on the complexity of your return. Everything is included Premium features IRS e-file 1099-G and more. The first10200 in benefit income is free of federal income tax per legislation.

There is no need to call the IRS or file a Form 1040-X Amended US. If you received unemployment benefits last yearyou may be eligible for a refund from the IRS. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust.

When it went into effect on March 11 2021 the American Rescue Plan Act gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. If none leave blank. Ad Learn How Long It Could Take Your 2021 Tax Refund.

ET The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a. The IRS has just begun May 14 sending out refunds for the. The IRS has promised to refund any taxes paid on the first 10200 of unemployment benefits earned last year but has said the money will go out this spring and.

Since May the IRS has been sending tax refunds to Americans who filed their 2020 return and reported unemployment compensation before tax law changes were made by the. What is the status on the unemployment tax break. Sadly you cant track the cash.

Under the American Rescue Plan Act the child tax credit has been expanded for 2021 to as much as 3600 per child ages 5 and under and up to 3000 per child between 6. Check For The Latest Updates And Resources Throughout The Tax Season.

Calculate Your Exact Refund From The 10 200 Unemployment Tax Break How Much Will You Get Back Youtube

10 200 Unemployment Refund Check Status How To Check Your Unemployment Refund With The Irs Youtube

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Unemployment Benefits Tax Refund Will You Receive One Waters Hardy And Co P C

Irs Sending You More Money Unemployment Refunds Coming Kare11 Com

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Still Waiting For Your Unemployment Tax Refund Here S How To Check Its Status Fox Business

When Will Irs Send Unemployment Tax Refunds 11alive Com

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Issues New Batch Of 1 5 Million Unemployment Refunds

When Will I Get My Irs Tax Refund Latest Payment Updates And Tax Season Statistics Aving To Invest

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

H R Block Good News Up To 10 200 Of Your Unemployment Income Could Be Tax Free The Irs Will Automatically Adjust Your Taxes And Any Refunds Will Start Going Out In May

Unemployment Tax Refund Update 10 Things You Need To Know About Your Irs Money